Car Tax Exemption Malaysia

Finance Minister Datuk Seri Tengku Zafrul Abdul Aziz said the exemption will now also cover completely knocked down CKD as well as completely built up CBU multi-purpose vehicle MPV and sports utility. First James is required to file in income tax for company car benefit under Section 13 1 b of the Income Tax Act ITA 1967.

What Are The Sst Exempt Ckd Cars You Can Buy In Malaysia In 2021 Wapcar

The exemption is limited to RM2000 per month for each residential home rented out and the residential home must be rented under a legal tenancy agreement.

. The proposal involves 100 duty exemption for CBU electric cars up to 31st December 2023 and 100 duty exemption for CKD electric cars up to 31st December 2025. 1 Sept 2018 MALAYSIA. The sales tax exemption currently in place for Malaysian consumers was first Budget 2022.

In a statement today the MOF said the. KUALA LUMPUR Dec 29 The Ministry of Finance MOF has announced the extension of the vehicle sales tax exemption period by a further six months until June 30 2021. This sales tax exemption on purchases of new vehicles was previously granted from 15 th June 2020 until 31 st December 2020 and was further extended by another 6 months to 30 June 2021 by the MoF as an incentive to spur car sales at a time.

The Ministry of Finance MOF has announced the extension of the vehicle sales tax exemption period by a further six months until June 30 2021. Sales Tax All 30 0 NIL 0 NIL 10 Notes. In a statement today the MOF said the full sales.

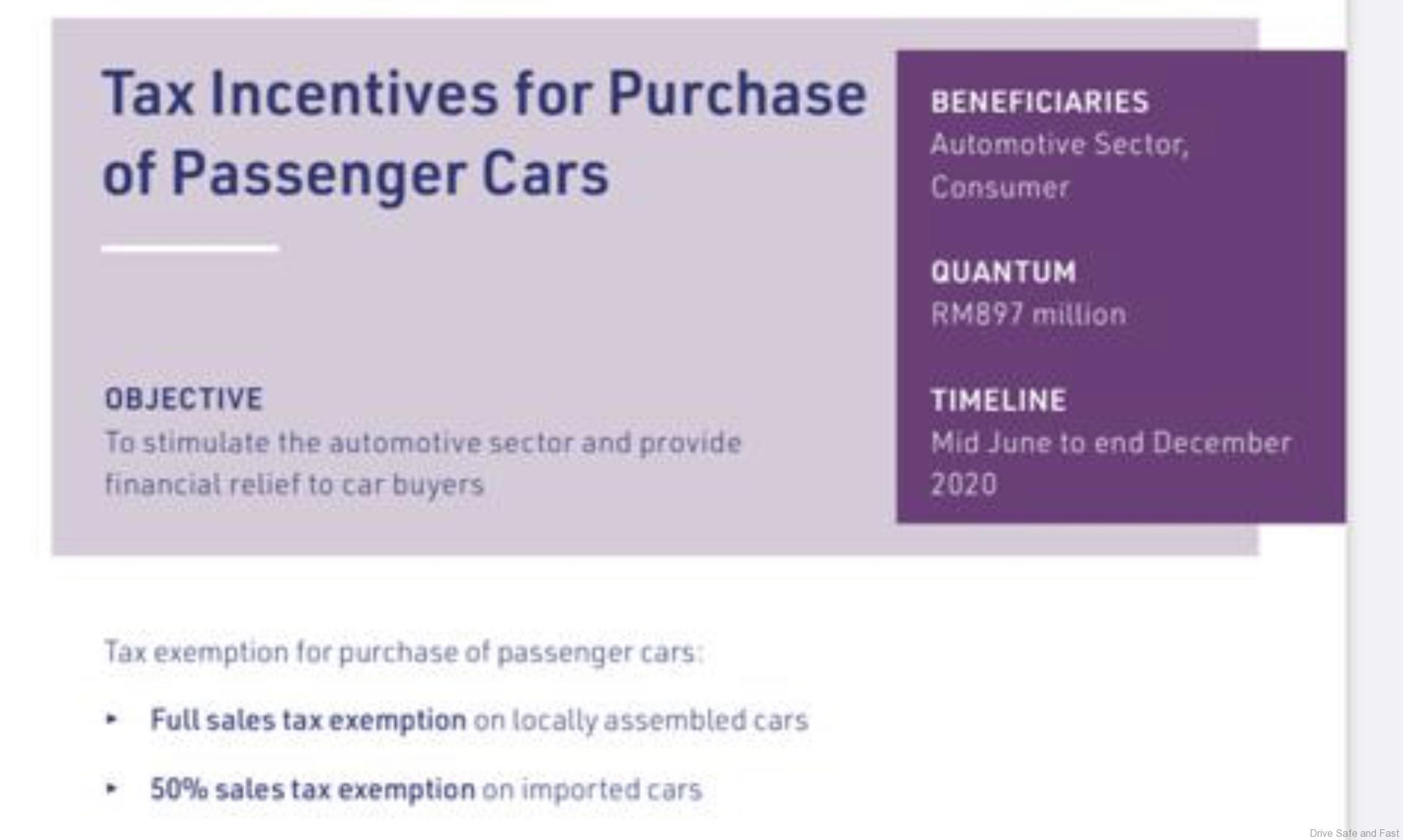

To reduce the cost of vehicle ownership the Government will extend the 100 sales tax exemption on CKD locally assembled passenger vehicles and 50 on CBUs imported including MPVs and SUVs. The government had previously given a sales tax exemption for the purchase of new vehicles for the period of June 15 to December 31 2020. This means buyers of locally-assembled CKD cars will be exempted from paying the 10 percent sales tax upon purchase.

This refers to the claims made by employees who are using their personal vehicle for official duties. As before the percentage of SST exemption remains unchanged from what was announced before with 100 exemption for locally-assembled CKD cars and 50 for fully-imported CBU cars. To promote the usage of energy-efficient vehicles with low carbon emissions the Malaysian government has revealed several incentives including a full tax exemption for the purchase of electric vehicles.

The sales tax exemptionreduction is applicable from 15-June to 31-December 2020. KUALA LUMPUR Oct 29 The government has agreed to continue the passenger vehicle sales tax SST exemption until June next year to encourage buyers. As you already know the government has announced that it will be waiving the 10 percent sales tax for locally-assembled CKD cars while imported CBU cars will see their sales tax reduced by half to 5 percent.

This was announced by Finance Minister Tengku Zafrul during the tabling of Budget 2022. How much is the sales tax for car in Malaysia. The government had previously given a sales tax exemption for the purchase of new vehicles for the period of June 15 to Dec 31 2020.

This means locally-assembled car prices ought to come down by 10 while CBU prices will be down by 5. For passenger cars in Malaysia there is a 100 sales tax exemption on locally-assembled CKD models and 50 on fully-imported CBU models for the period mentioned. DUTIES TAXES ON MOTOR VEHICLES A PASSENGER CARS INCLUDING STATION WAGONS SPORTS CARS AND RACING CARS CBU CKD CBU CKD IMPORT DUTY IMPORT DUTY LOCAL TAXES CBU CKD CBU CKD.

You are required to pay taxes for your income arising from any rent received but there is a 50 tax exemption in this category for Malaysian resident individuals. The current exemption of the 10 percent sales and services tax SST for new locally-assembled passenger cars imported cars are taxed at a discounted 5 percent rate in Malaysia will expire by 31-December 2021. It is viewed as employment income to James because it is a company car benefit provided by P-Tech his company for his continuous employment.

Travelling allowances of up to RM6000 for petrol and tolls are granted a tax exemption if the vehicle used is not under the ownership of the company. Starting the 15th of June and ending on the 31st of December 2020 locally-assembled models will get 100 sales tax exemption while fully-imported models will receive 50 sales tax exemption. As it stands sales tax rate are both CKD and CBU are 10.

However do note that other taxes like excise and import duties still apply. Specifics on how will this be implemented are still unclear so we will have to wait a little. MFN Most Favoured Nation rate ATIGA ASEAN Trade in Goods Agreement Updated.

Locally assembled or completely knocked down CKD cars will continue to be given the 100 sales tax exemption whereas a 50 tax exemption is levied on imported or completely built up CBU passenger cars. The sales tax for vehicles in Malaysia is currently set at 10 for both locally assembled and imported cars so the exemption means that the sales tax. In Malaysia sales tax for vehicles has been set at 10 for both locally assembled and imported cars.

It is viewed as employment income to James because it is a company car benefit provided by P. The Sales and Service Tax SST exemptiondiscount for new cars has been extended to 31-December 2021. The sales tax for vehicles in Malaysia is currently set at 10 for both locally assembled and imported cars so the exemption means that the sales tax.

According to the Malaysian Finance Minister on October 29 2021 a sales tax SST exemption of 100 percent for Completely Knocked Down CKD passenger vehicles and 50 percent for Completely Built Up CBU vehicles including MPVs and SUVs will be extended for six months until June 30 2022 which was. In his case the company car benefit James needs to file in are. Buyers who registered their cars on or after 1-January 2022 will have to pay more irrespective of when they placed their orders.

M Sian Govt Extends Sst Exemption Until 31 December 2021

Muhyiddin Sst Exemption For New Ckd And Cbu Cars Extended Until 31 December 2021 Soyacincau

Evs Officially Exempted From Road Tax Until 2025 Oku Also Get Rebate For Modified National Ckd Vehicles Paultan Org

4 More Months To Enjoy Car Sales Tax Exemption Incentive

2020 Sst Exemption All The Revised Car Price Lists Paultan Org

New Maserati Grecale 2022 World Premiere Luxury And Powerful Suv In 2022 Maserati Sports Car Cars Trucks

Four More Months To Enjoy Car Sales Tax Exemption Incentive Says Tengku Zafrul The Edge Markets

Car Valuation Car Car Dealership Honda Shuttle

Electric Car Market Share Financial Incentives Country Comparison Incentive Financial Share Market

Toyota Camry 2 0 G Toyota Camry Camry Toyota

Sales Tax Exemption On Passenger Cars In Malaysia How Much Will You Save

Malaysia Budget 2022 Suggestions What To Ask For More Sst Relief Lower Car Tax Cheaper Evs And Tolls Paultan Org

Penjana Car Sales Tax Exemption 1 Paul Tan S Automotive News

Perodua Cars New Peninsular Malaysia Langkawi Labuan

Baojun E100 All Electric Battery Cars Are Seen While Being Charged In The Parking Lot In Front Of A Baojun N Climate Change Solutions Sustainable Transport Car

Sales Tax Exemption On Ckd Cbu Cars Extended Again To 30 June 2022 Nextrift

Four More Months To Enjoy Car Sales Tax Exemption Incentive Tengku Zafrul

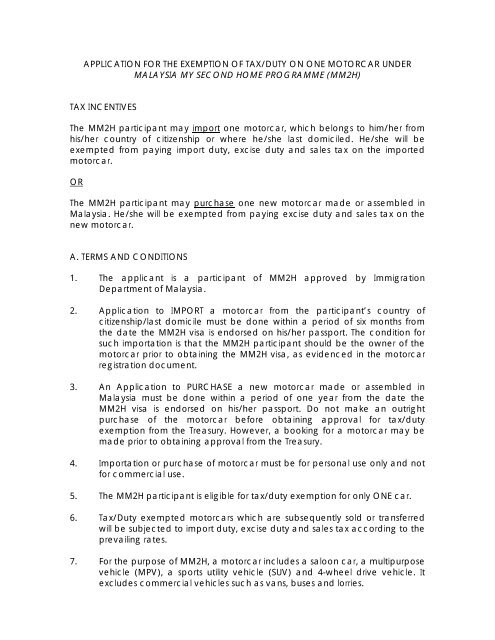

Bringing In Personal Car With Duty Tax Exemption Malaysia My

Four More Months To Enjoy Car Sales Tax Exemption Incentive Tengku Zafrul

Comments

Post a Comment